Divorce can be a challenging and emotionally draining experience, especially when it involves the distribution of assets, such as property. In Singapore, many couples own either Housing and Development Board (HDB) flats or private properties, and deciding who gets to keep the house can be a complex decision that is dependent on many factors.

Read on for the legal considerations and options for couples when deciding what to do with their home after divorce.

Is the Home a Matrimonial Asset?

In Singapore, under the Women’s Charter, the definition of “Matrimonial Assets” encompasses all property acquired by both parties during their marriage.

Therefore, whether a property is obtained jointly or solely in the names of either spouse, it is still classified as a matrimonial asset.

Furthermore, the property in which the couple resides and nurtures their marital life is recognised as their “Matrimonial Home”. Matrimonial home holds a special place and is regarded as the “cradle of family life” Hence, regardless of whether the property was acquired prior to the marriage or gifted to one of the spouses, it will still be treated as a matrimonial asset.

Read more: Gifts In The Division Of Matrimonial Assets

Division of the Matrimonial Property

The HDB property that falls within the definition of a “Matrimonial Asset” will be divisible between the spouses in the event of a divorce. When deciding on the division of the matrimonial assets, the Court will do so in a “Just and Equitable manner”

The Court will consider all factual circumstances of each case to arrive at a just and equitable division, including the financial contributions towards the acquisition of the property (eg., mortgage payments), non-financial contributions (eg., maintenance of the household by cleaning or repairing, caring for family, etc.), which parent has care and control of the children, whether there are pre- or post-nuptial agreements, working and earning capabilities of the spouses and the debts undertaken by each spouse.

These factors will allow the Court to determine the proportion of the assets which each spouse would receive following the divorce. Again, your divorce lawyer can help you assess how a Court may regard your situation.

Read more: Factors Influencing Division of Matrimonial Assets

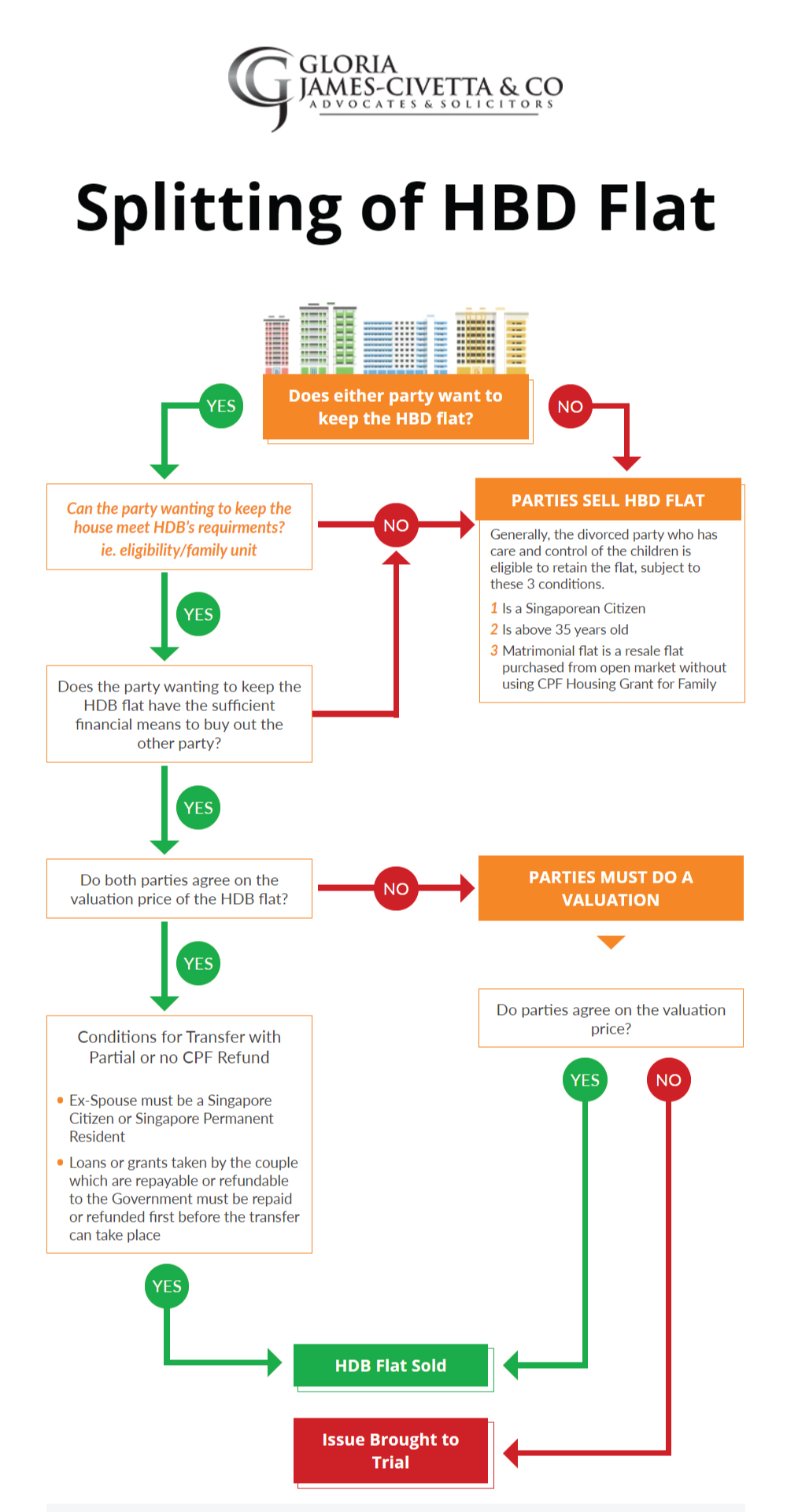

Who Gets Ownership of The HDB Flat?

If you and your spouse agree on how to divide the flat after the divorce

Either one spouse can transfer their rights and interests to the other spouse who will continue to hold the flat in their sole name or the flat could be sold and the proceeds divided between the spouses. In such cases, the divorce agreement should record these agreed terms.

Parties will generally only be permitted to submit the application for the intended transfer after the divorce is finalised.

Do note that if parties decide on selling the flat, they must still ensure that they have met the minimum occupancy period (MOP) of at least 5 years. If you have not met the MOP of your flat, you may appeal to the HDB who would decide on a case-by-case basis.

If you and your spouse cannot agree on the division of the HDB Flat

In the event parties are unable to agree on the division of the HDB flat, the Court will have to determine what is a just and equitable division after hearing parties at an ancillary matters hearing.

Read more: What Happens to My HDB Flat if I Divorce Before MOP?

Retaining Your Public Housing Flat

The parent with sole care and control of the children would usually prefer to continue staying in the family home to minimise disruptions to the children’s lives. However, before deciding on keeping the house, you need to ensure that you meet the eligibility criteria to hold the flat in your sole name.

If you wish to retain the HDB flat, do note that retaining an HDB flat may depend on the following:

- Whether parties have fulfilled the MOP (Minimum Occupation Period).

- The party’s financial ability to buy over the spouse’s share of the flat (including CPF refunds).

- The party’s financial ability to bear any HDB/housing loan repayments.

- The party typically needs to be above 35 years of age or have care and control of the children to retain a flat in their sole name.

- Whether the party can form a family nucleus (the household can comprise of a child they have care and control of, their parents or their siblings).

You will also be permitted to retain the HDB flat under the Single Singaporeans Scheme if you meet the eligibility criteria below:

- do not have children

- are a Singaporean citizen

- at least 35 years old, and

- your matrimonial home is a home purchased on the open market that does not qualify for a CPF housing subsidy for your family

In addition to the abovementioned HDB eligibility criteria, you may need to consider whether or not you have sufficient funds to continue paying for the mortgage of the flat on your own and/or whether or not you are able to obtain refinancing.

Read more: Divorce & CPF Contributions

Transfer of Ownership for Private Property

For private property, parties can similarly agree on how to deal with the flat or leave it to the Court to determine. However, it is usually a more straight-forward process as there are no eligibility criteria nor MOP to fulfil before the flat is sold.

Do note that the party intending to buy over the other party’s share will still need to ensure they have sufficient funds to continue the mortgage loan. You will also need to come to a consensus on the CPF funds to be refunded to the spouse relinquishing their share of the property.

What Happens When You Sell/Dispose of the Flat in the Future?

If you sell or dispose of the flat in any way in the future and your spouse had previously transferred their share of the flat to you with partial or no CPF refunds, you will still have to refund the following:

- CPF monies used by your spouse to purchase the flat that you didn’t refund when they transferred the flat to you, including accrued interest;

- CPF Account withdrawals, including accrued interest, for the flat;

- If applicable, your and your spouse’s pledged retirement sum (using the flat).

In conclusion, dealing with your house is often a challenging transition for the divorcing couple. While some may decide to continue living together in the same home after the divorce to save costs, this may also not be ideal in some cases.

Whether parties decide to continue living together or live separately, it is essential to ensure their dependents, especially the children, have stable accommodations so that their routine is not disturbed.

Read more: Tips to Protect Assets in Divorce

What Can GJC Do to Help?

At GJC Law, we are committed to providing you with the legal help you need when you need it most, regardless of your situation.

You can trust that we offer a high standard of representation and compassionate guidance from the start to the end of your matter, and are committed to providing affordable fees to suit your needs and budget.

GJC Law credits Noelle Teoh for her advice.